Focus Investing – Introduction

Focus investing is the process of investing in only a limited number of businesses, after in-depth research and analysis. This method results in a lower turnover ratio, better knowledge of, and more involvement in the underlying business. Doing it correctly improves the probability of getting above-average returns and beating the market.

Many investors have the Fear-of-missing-out (FOMO) or the herding effect tendencies. They find it hard to suppress their need to always be in action. Thus, they frequently invest in one or the other stocks adding it to their Focus portfolio. With higher turnover and lesser knowledge of underlying businesses, the essence of Focus Investing goes for a toss. To better manage the Focus Portfolio, Warren Buffett and Charlie Munger suggested using the 20-slot rule.

20-slot rule

In a 1994 commencement speech at the University of Southern California, Berkshire Hathaway vice chairman Charlie Munger revealed one lesson, called the “20-slot” rule, that he says Buffett loves to teach when lecturing at business schools.

According to Munger, Buffett starts by telling MBA students, “I could improve your ultimate financial welfare by giving you a ticket with only 20 slots in it so that you had 20 punches — representing all the investments that you got to make in a lifetime. And once you’d punch through the card, you couldn’t make any more investments at all.”

Under those rules, Buffett explains, “you’d really have to think carefully about what you did, and you’d be forced to load up on what you really think about. So you’d do much better.”

In addition to the 20-slot rule that helps in optimizing investment decisions, Buffett has a yardstick to decide on adding a new investment to the existing focus portfolio.

Buffett’s Measuring Stick

When Buffett considers adding an investment, he first looks at what he already owns, to see whether the new purchase is any better. What Berkshire owns today is an economic measuring stick used to compare possible acquisitions.

“For an ordinary individual, the best thing you already have should be your measuring stick. If the new thing you are considering purchasing isn’t better than what you already know is available, then it hasn’t met your threshold. This screens out 99 percent of what you see.”

Charlie Munger on Buffett’s approach

This leads to a question – How to identify the correct stock for Focus Portfolio?

Probability – Mathematics of selecting the stocks for Focus Portfolio

Warren Buffett used the concept of Probability to pick the stocks with the best odds of winning.

The process could be divided into four steps.

1. Estimate the probabilities of success

2. Adjust for new information

3. Decide how much to invest

4. Wait for the best odds of winning

Estimate the probabilities of success

As a focus investor, you restrict yourself to a limited number of stocks because you know that, in the long run, it is your best chance of doing better than the overall market. So, when thinking about buying a new stock, your goal is to make sure your choice will outperform the market. That is the probability you are concerned with: What are the chances that this stock, over time, will achieve an economic return greater than the market? Using frequency if it is available, and subjective interpretation if it is not, make your best estimate.

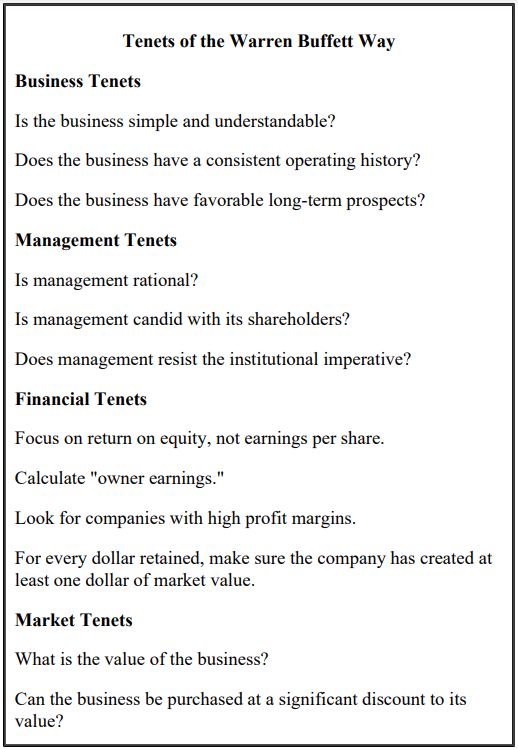

What you will be looking at is how closely the company you are considering matches up to the tenets of the Warren Buffett Way. Do the most thorough job you can of collecting information about the company. Measure it against those tenets, and convert your analysis to a number. That number represents how obvious it is to you that the company is a winner.

Buffett measures the performance of a company against the four tenets. These tenets give a holistic view of past and current performance and long-term prospects of the company. By meticulously analyzing the company’s performance for all the tenets one can estimate the probability of its success in the long run.

Adjust for new information

Knowing that you are going to wait until the odds turn in your favor, pay scrupulous attention to whatever the company does. Is management beginning to act irresponsibly? Are the financial decisions beginning to change? Has something happened to change the competitive landscape in which the business operates? If so, the probabilities will likely change.

Decide how much to invest – The Kelly Formula

Out of all the funds you have available for investing in the market, what proportion should go to this purchase? To estimate what fraction of the available fund could be used to purchase the stocks of a given company, one can apply The Kelly formula.

The Kelly Optimization Model, often called the optimal growth strategy, is based on the concept that if you know the probability of success, you bet the fraction of your bankroll that maximizes thegrowth rate. It is expressed as a formula:

2p-1=x

where 2 times the probability of winning minus 1 equals the percentage of one’s bankroll that should be bet.

Suppose the probability estimate for the success of investing in a stock is 55%, that means following the Kelly Model one can bet 2(0.55)-1= 0.10=10% of the available funds.

Using the Kelly approach requires constant recalculations and adjustments throughout the investment process. Nonetheless, the underlying concept, mathematically linking the degree of probability to investment size, carries important lessons for the focus investor.

There is no evidence that Buffett uses the Kelly model when allocating Berkshire’s capital. But the Kelly concept is a rational process, and it neatly echoes Buffett’s thinking. Buffett has counseled investors to wait until the best opportunities appear and then be willing to bet big.

The Kelly model is an attractive tool for focus investors. However, it will benefit only those who use it responsibly. There are risks attached to employing the Kelly approach. It would be wise to understand its three limitations:

(i) Long-term horizon – First, anyone who intends to invest, using the Kelly model or not, should have a long-term horizon. Even when the investor has selected the correct company, the market may take some time in rewarding the selection. The investor should trust the selection and not panic in such cases, provided in-depth analysis and research are done.

(ii) Using leverage – The danger of borrowing to invest in the stock market (with a margin account) has been trumpeted loudly by both Ben Graham and Warren Buffett. The unexpected call on your capital can occur at the most unfortunate time in the game. If you use the Kelly model in a margin account, a stock market decline can force you to remove your high-probability bets.

(iii) Risk of overbetting – The Kelly Model relies on the precision of calculating the probability of success. What is an investor estimating the probability to be 70%, when it actually is 50%. The way to minimize that risk is underbetting—using a half-Kelly or a fractional Kelly model. So, if the probability estimate of success is 60%, investors can use 40% or any percentage lower than 60% to shield themselves against the loss due to overbetting.

Wait for the best odds of winning

The odds of success tip in your favor when you have a margin of safety; the more uncertain the situation, the greater the margin you need. In the stock market, that safety margin is provided by a discounted price. When the company you like is selling at a price that is below its intrinsic value (which you have determined in the process of analyzing probabilities), that is your signal to act. One must pay attention to the adequate margin of safety.

Why margin of safety is important?

Divergence in valuation – Most valuations are based on certain assumptions. While most of these assumptions are empirically tested, they could well go wrong. Hence a higher level of margin of safety will ensure that the investor is protected from such divergences in valuations.

Account for volatility – Many local and global factors might turn all the projections of future potential and calculations on their head. There might be a global recession, or a change in management with the new managers not performing as per expectations, or any other factor. The margin of safety protects an investor from such unexpected events.

Estimation mistakes – Since an investment is based on the probability of success, there might be mistakes in the calculation of the probability. An error could be in the estimate of the future potential of the company or the calculation of intrinsic value. A margin of safety thus provides a safety cushion against such mistakes.

Protection against unknown – There may be some risks that the investors may have overlooked or not recognized during the initial calculations. Ben Graham referred to these risks as the “Unknown – Unknown”. By buying the stocks deeply below the intrinsic value, an investor stands a better chance of beating the odds and avoids getting adversely impacted by market downturns.

The process of calculating the intrinsic value, estimate of future potential, and margin of safety is a continuous loop. An investor must revisit and assess frequently to increase the odds of success. When the odds are high, the investors should bet big

“It’s not given to human beings to have such talent that they can just know everything about everything all the time. But it is given to human beings who work hard at it—who look and sift the world for a mispriced bet—that they can occasionally find one. The wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don’t. It’s just that simple.”

Charie Munger