Table of Contents

What is Focus investing?

Focus Investing is a strategy where the investor or a portfolio manager invests only in a limited number of stocks after thorough research and analysis. Focus investing significantly increases the odds of beating the market and of above-average results if done right.

The essence of Focus investing is to choose a few stocks that are likely to produce above-average returns over the long haul, concentrate the bulk of your investments in those stocks, and have the fortitude to hold steady during any short-term market gyrations.

Key principles of Focus Investing

1. In-Depth Research and Understanding

Focus investing involves investing in a limited number of stocks. The selection of these stocks is based on thorough research and a deep understanding of fundamentals. Since the size of the portfolio is small, focus investors dedicate significant time and effort to getting maximum insights and information about the companies they choose. The whole idea of focus investing revolves around having a deep understanding of all the aspects of the companies that form part of the portfolio.

Warren Buffett is one of the most successful proponents of focus investing. He believes that focus investors have better odds of beating the index compared to active or index investors.

Buffett is not interested in the day-to-day fluctuations of the stock market. According to him, if the company itself is doing well and is managed by smart people, eventually its inherent value will be reflected in its stock price. Buffett devotes most of his attention to analyzing the fundamentals of the underlying businesses and assessing their management.

Rather than obsessing with the daily ups and downs of stock prices, focus investors dedicate their energies towards analyzing financial statements, understanding the competitive landscape, and staying abreast of industry trends.

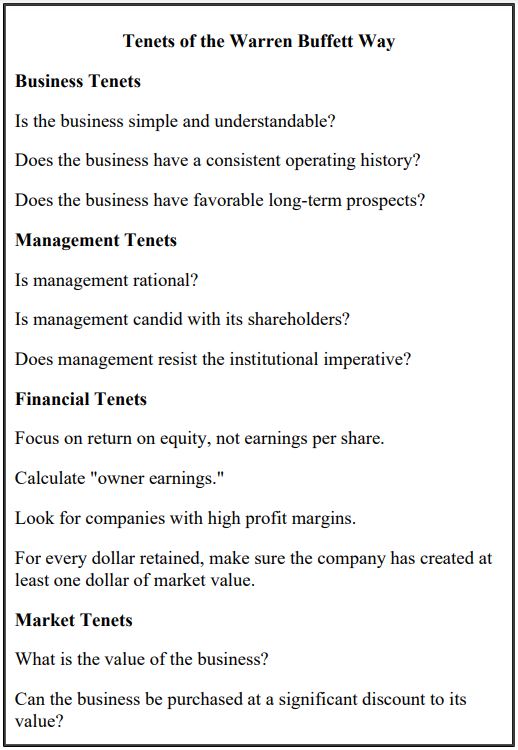

The time required for research is directly proportional to the size of our stock portfolio. For analysis and research, Buffett checks each investment opportunity against a set of tenets. Each of these tenets is an analytical tool. These tenets help in isolating the companies with the best probability of high economic returns.

In a competitive match, the team management ensures that the best players are selected to increase the chance of winning. Similarly, Warren Buffett’s tenets help in identifying good companies for a strong focus portfolio. Buffett’s tenets help in selecting companies with superior past records, strong fundamentals, and stable management. This increases the probability of continuing the strong performance in the future also, as in the past. This is at the heart of focus investing – Focusing on the companies that have the highest probability of above-average performance.

So what is wrong with conventional diversification(active or index investment)?

For one thing, it greatly increases the chances of buying something one doesn’t know enough about.

2. Concentrated Portfolio – “Less is more”

Focused investing involves building a concentrated portfolio with a limited number of carefully chosen stocks. All these stocks are selected after thorough research and analysis, and based on rigorous shortlisting criteria. This concentrated approach with only a few businesses in the portfolio allows the investors to closely monitor each investment. Unlike other investment portfolios with much larger sizes, a focus portfolio with its limited size makes it possible to understand the dynamics of each constituent business and react swiftly to any new update.

“If you are a know-something investor, able to understand business economics and to find five to ten sensibly priced companies that possess important long-term competitive advantages, conventional diversification [broadly based active portfolios] makes no sense for you.”

Warren Buffett

In conventional diversification, the number of companies is large. This greatly increases the chance that we end up owning a company we know nothing about and have no idea of its past performance or future expectations. Know-something investors applying Buffet’s tenets on a focus portfolio have a better chance of doing better than the active or index portfolio investors.

So what should be the size of the concentrated portfolio?

Any size less than 15 is fine, as long as the portfolio manager can follow and scrutinize the information and details of each constituent company. A size larger than 15, or higher than the capacity of the portfolio manager defeats the purpose.

The limited number of companies in a Focus portfolio disciplines us to choose only the best that have the greatest chance of success – a natural selection of sorts.

“It is a mistake to think one limits one’s risks by spreading too much between enterprises about which one knows little and has no reason for special confidence. One’s knowledge and experience are definitely limited and there are seldom more than two or three enterprises at any given time in which I personally feel myself entitled to put full confidence.”

Keynes wrote to a business associate in 1934

Though the concept of Focus investing was not introduced then, Keynes’ investment philosophy suggests he was one of the earliest known practitioners of focus investing.

3. Put big bets on high-probability events

Fisher’s investment philosophy has a profound influence on Warren Buffett. Fisher believed that when you encounter a strong opportunity, the only reasonable course is to make a large investment. Like all great investors, Fisher was very disciplined. To understand as much as possible about a company, he made countless field trips to visit companies he was interested in. If he liked what he saw, he did not hesitate to invest a significant amount of money in the company.

Warren Buffett echoes that thinking: “With each investment you make, you should have the courage and the conviction to place at least 10 percent of your net worth in that stock.”

According to Buffett, an ideal focus portfolio should have not more than 10 stocks. Focus investing is not a simple matter of finding ten good stocks and dividing the investment pool equally among them. Even though all the stocks in a focus portfolio are high-probability events, some will inevitably be higher than others and should be allocated a greater proportion of the investment.

Investments of Warren Buffett in American Express and Washington Post are some of the examples of his assessment of businesses for focus portfolio.

4. Patience – Long time horizon

A focus portfolio encourages a long-term perspective. For the investment to realize its full potential, a portfolio must be held over a long time horizon. This approach aligns with the idea that the market may undervalue or misprice assets in the short term, and patience is often rewarded as the market corrects itself over time.

Unlike the active or Index portfolio approach, the focus portfolio is less diversified and has a lower turnover ratio. Among all active strategies, focus investing stands the best chance of outperforming an index return over time. For this, it requires investors to patiently hold their portfolio even when it appears that other strategies are marching ahead.

In shorter periods, we realize that changes in interest rates, inflation, or the near-term expectation for a company’s earnings can affect share prices. But as the time horizon lengthens, the trend-line economics of the underlying business will increasingly dominate its share price.

There is no hard and fast rule for the minimum time to stay invested, but a timeline of at least five years is recommended.

Huge efforts and rigorous analysis are invested while selecting the best possible businesses for focus investing. But this does not mean that turnover should be zero. The ideal turnover rate should be between 10 and 20 percent.

5. Conviction in the underlying businesses

Investors must have a strong belief in the fundamental value and potential of their chosen investments. This conviction helps them withstand short-term market fluctuations and noise. Lack of conviction makes the investors vulnerable to cognitive biases like herding effect, overconfidence, mental accounting, and loss aversion, among others.

6. Discipline

Discipline is vital for adhering to the investment strategy, resisting impulsive decisions, and staying focused on the long-term goals despite market volatility. Have a methodology, improve it and it will become an iterative life-long approach for the investor. Lack of discipline may lead to investors letting short-term market fluctuations influence their buying or selling decisions. Investors must have control over cognitive biases. Lack of discipline leads to impulsive decisions. Such missteps can gradually turn a focus portfolio into an unstable portfolio, thus erasing all the benefits of a high-quality portfolio of fundamentally strong businesses,

7. Risk Management

Focused investing places a significant emphasis on effective risk management. While having a concentrated portfolio can amplify returns, it also increases the exposure to individual investment risks.

Investors following this approach implement rigorous risk management strategies to mitigate potential downsides. This includes diversification within the chosen focused investments, setting predefined exit points, and continuously reassessing risk factors.

Risks can not be completely eradicated as investments are based on the probability of successful returns. But risks could be reduced by ensuring that:

i) Thorough research and analysis is performed for each business,

ii) All sources of important information about constituent businesses are meticulously scrutinized, and

iii) all investments have deep margins of safety.

Summary- The golden rules of focus investing are:

1. Concentrate your investments in outstanding companies run by strong management.

2. Limit yourself to the number of companies you can truly understand.

3. Pick the very best of the good companies and put the bulk of investments there.

4. Think of the long term, so that investments realize their full potential value.

5. Market volatility is short-term, and should not influence the decisions 6. Proper risk management